Yield Basis: The First Sustainable BTC Yield

Yield Basis solves BTCFi’s hardest problems, but its token economics and crvUSD dependency constrain short-term growth

Executive Summary

Yield Basis introduces a golden opportunity for a trillion-dollar target market (idle BTC holders), providing leveraged liquidity pools that deliver BTC-denominated yield without impermanent loss. However, scalability is structurally (and intentionally) constrained by reliance on crvUSD credit tranches. After the YB token presale on Legion attracted nearly $200M in demand, the current pre-market valuations have neared $1Bn FDV. This represents a steep premium to current fundamentals, as explored later in the piece. The protocol’s design is fundamentally sound and a real breakthrough in the BTCFi sector, but its token economics and Curve DAO reliance present significant risks.

Market Context

Most DeFi protocols in recent years have been forks of existing models layered with token incentives of points programs. Rather than follow this model, Yield Basis takes a different approach and addresses two of the largest problems in the DeFi space head-on.

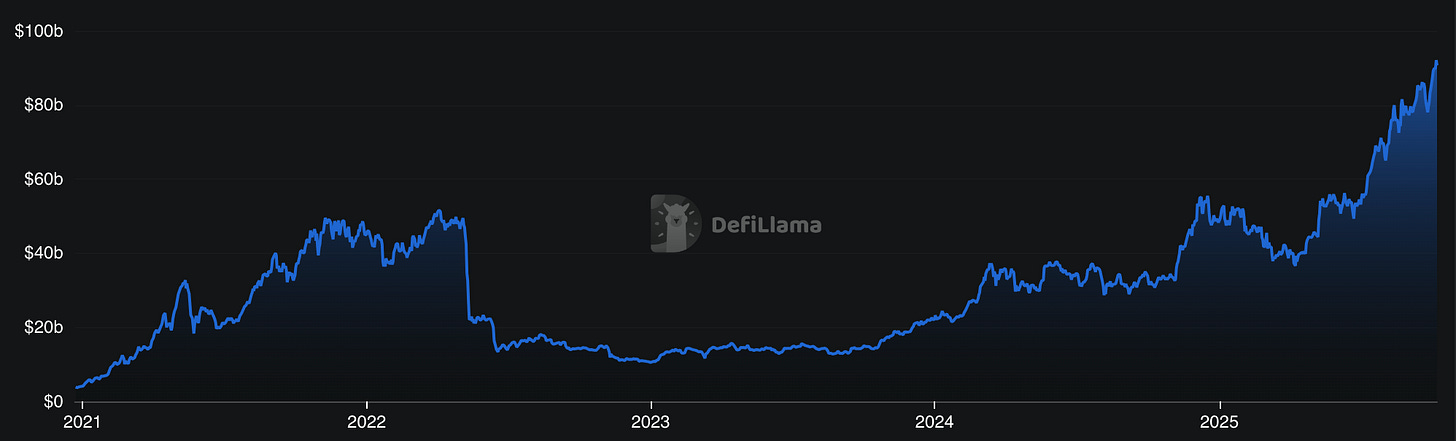

First, people want their BTC working for them. BTC staking and restaking has become a $10Bn+ market, where today’s ‘yield’ is largely driven by speculation and airdrop farming. In the current market, users deposit BTC to earn points or tokens from protocols that aren’t generating adequate revenue.

Meanwhile, there’s well over a trillion dollars in BTC sitting idle onchain, doing nothing. If these long-term holders had a safe and sustainable way to earn non-speculative yield on their BTC, it’s safe to say that many of them would jump at the opportunity. Considering that sub-prime BTCFi solutions have attracted 11-figure inflows, it’s clear that demand for BTC-denominated yield is not the bottleneck.

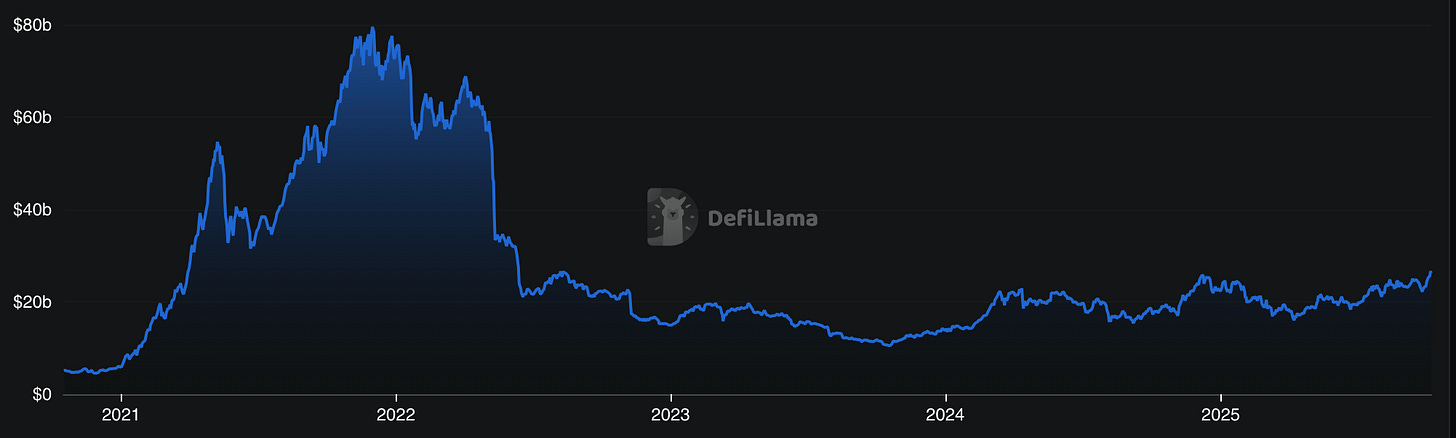

On the other hand, AMMs have carried the pain point of impermanent loss since inception. The DeFi sector has seen Borrow/Lend products mature greatly, while liquidity provision has remained stagnant. Protocols like Aave, Morpho, and Maple have seen consistent adoption, as they allow depositors to retain full exposure to their assets while earning predictable returns. Even with CLMMs and other innovations, liquidity providers still eat impermanent loss, forcing many protocols to rely on short-term incentives to maintain TVL.

The Yield Basis Model

Yield Basis structurally solves both of these problems by offering leveraged liquidity pools that eliminate impermanent loss. Wrapped BTC deposits on Yield Basis earn BTC-denominated yield derived from trading activity rather than from airdrop speculation. The pools are designed to maintain a constant 2x leverage ratio, ensures that the user’s deposit maintains a 1:1 backing with BTC’s price action.

To explain the protocol mechanism briefly:

Users deposit wBTC

The protocol borrows an equal amount of crvUSD

Both sides are deployed into a Curve V2 Cryptoswap pool (wBTC/crvUSD), doubling liquidity while maintaining 1:1 BTC price exposure

As trades occur, the pool accrues fees, half of which are directed towards automated rebalancing. The remaining half represents real revenue paid by traders swapping between wBTC and crvUSD, which flow back to depositors as BTC-denominated yield. Rebalancing operations are executed by arbitrageurs and funded by trading activity, which keeps leverage precisely at 2x. This ensures the deposit continues to mirror BTC’s price movements. In practice, this means that if BTC appreciates or depreciates by 10%, the position tracks it one-for-one rather than overexposing to the depreciating asset as in traditional AMMs. By combining constant 2x leverage, full BTC price exposure, and sustainable BTC-denominated income, Yield Basis offers a superior alternative to the 11-figure BTC staking market and the $1T+ in idle BTC capital.

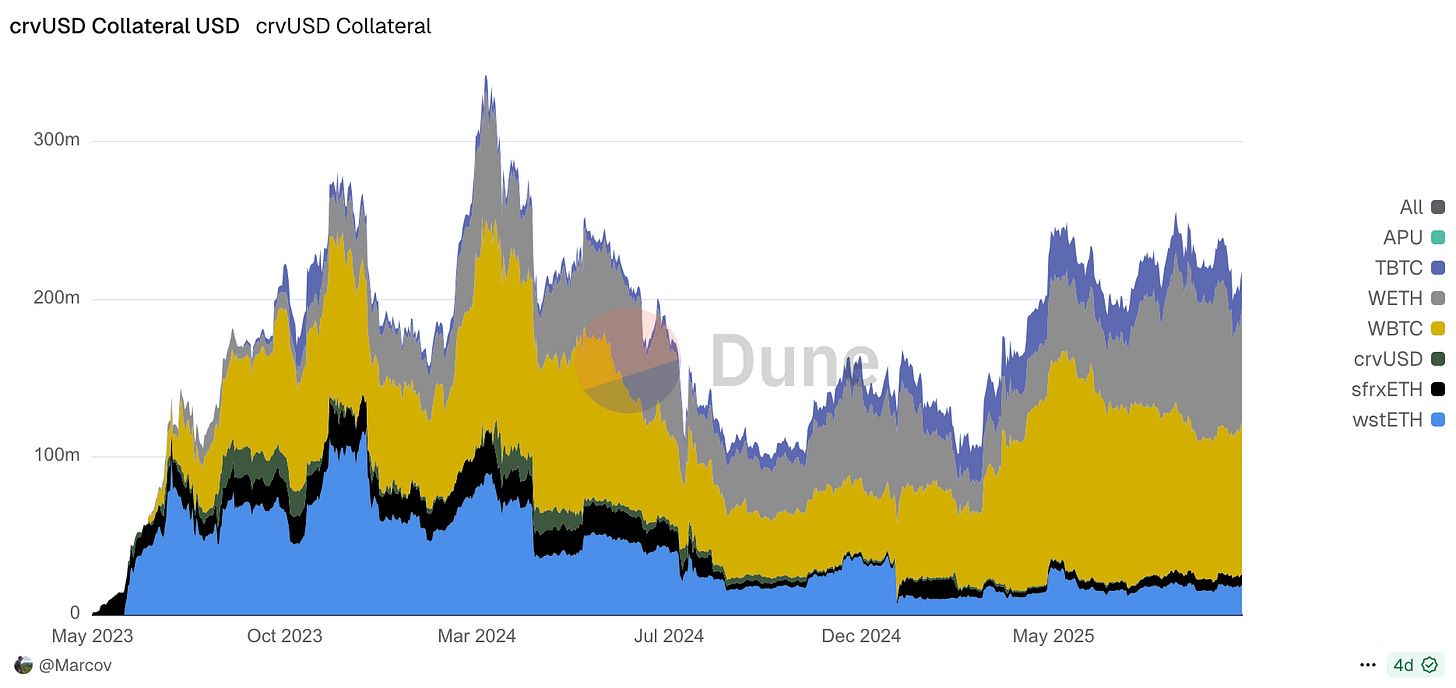

Constraint: YB’s Growth Ceiling = crvUSD’s Credit Ceiling

Yield Basis draws its borrowing capacity entirely from Curve’s crvUSD system. crvUSD is under $200M market cap with a $60M credit line approved for YB, meaning over one-third of crvUSD’s supply is siloed for YB pools. Each tranche sets a hard cap on crvUSD liquidity available to Yield Basis, with an excess reserve allocated to manage risk in the case of significant BTC volatility. The team has confirmed that TVL caps must be raised via additional Curve DAO approvals before the YB token goes live. This introduces a hard bottleneck for Yield Basis, as the protocol cannot scale beyond the Curve DAO’s willingness to expand credit tranches.

For Yield Basis to achieve a 4x TVL increase from today’s $30M cap, crvUSD’s market cap would need to double. Furthermore, for YB to reach a reasonable 20x price-to-revenue multiple, crvUSD’s market cap must increase by several billion. This ties YB’s growth trajectory to crvUSD adoption and Curve DAO’s governance. Demand will never be the problem for Yield Basis, rather credit supply will.

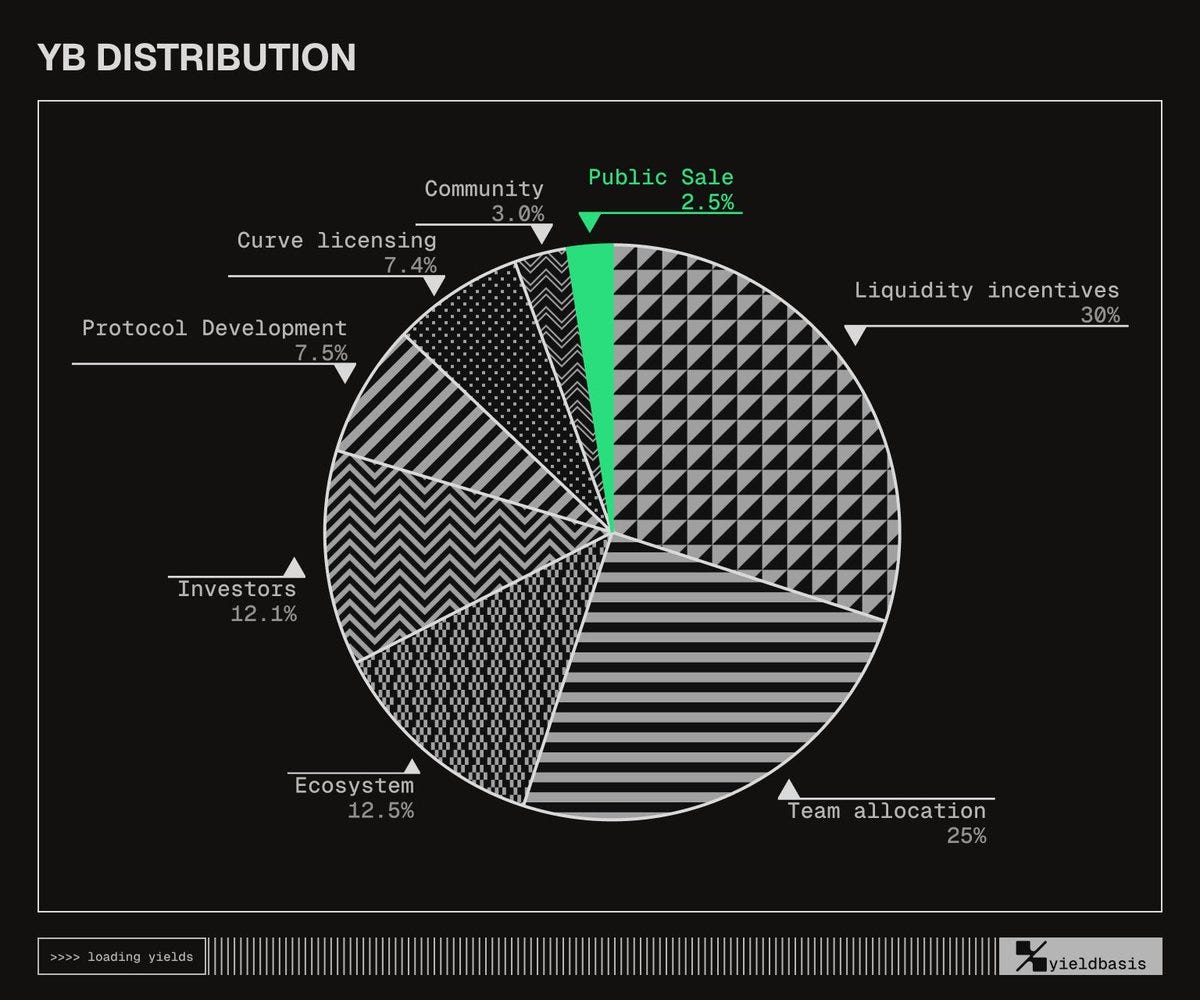

Valuation & Tokenomics Stress Test

The YB token presale generated extraordinary interest: the Legion merit-based sale was oversubscribed by nearly 100x, and Kraken’s FCFS tranche filled in seconds. This market frenzy has extended into pre-market trading platforms, where millions in volume have driven speculative valuations far beyond fundamentals. At current pre-market valuations, YB trades at a $900M FDV with around $30M TVL generating 8% vAPY, implying a price-to-revenue multiple exceeding 500x.

Tokenomics Primer

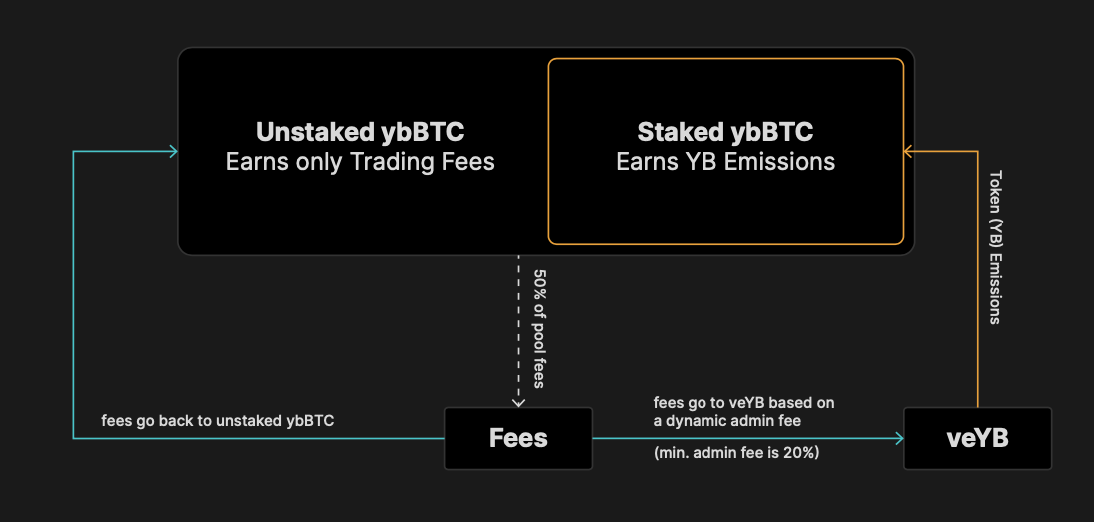

When users deposit their wrapped BTC into Yield Basis, they receive ybBTC representing their LP position. From here, depositors have a choice:

A - Stake your ybBTC, farming YB emissions but forfeiting the BTC-denominated yield

B - Don’t stake your ybBTC, earning the BTC-denominated yield from trading fees

Option A is designed to bootstrap liquidity and distribute ownership of the protocol’s governance token, while Option B respects the protocol’s fundamental value proposition (providing non-speculative BTC yield). These two paths are meant to coexist as a balanced equilibrium, where some users stake for governance and YB speculation, while others remain unstaked and earn native BTC yield. However, this balance only holds true when YB emissions are proportional to the protocol’s net revenue.

The Core Problem

At current conditions:

FDV = $900M

TVL = $30M

vAPY = 8% → $2.4M annualized fees

Emissions = 75M YB → $67.5M annualized emissions

As mentioned previously, 50% of the all pool fees are directed towards automated rebalancing, which maintains the 1:1 BTC peg. After allocating for this difference, the protocol’s net revenue is around $1.2M, resulting in an emissions-to-revenue multiple above 56x. Assuming TVL will grow 4x before the launch (to $120M), emissions would still outweigh earnings by ~14x.

This imbalance tilts incentives entirely toward staking and emission capture. Behaviorally, all rational LPs will capitalize on this opportunity in the short-term. This dynamic will cause YB unlocks to sustain persistent sell pressure, as token emissions at current valuations front-run fundamentals. Users will take the most profitable route, incentivizing short-term extraction over long-term alignment despite the protocol’s exceptional pool design.

Can crvUSD Scale 20x Safely?

crvUSD is Curve’s overcollateralized stablecoin, designed to maintain its peg through a soft-liquidation system that gradually rebalances collateral. The design eliminates the risk of sudden cascading liquidations and MEV extraction. This makes crvUSD stronger than traditional algorithmic stablecoins, but its growth is currently constrained by collateral supply.

Today, the crvUSD supply is under $200M, mostly backed by wBTC and wETH. Each further credit line to expand YB’s growth will require explicit approval by the Curve DAO, and scaling an overcollateralized stablecoin to 10-figures in supply would require billions in backing, likely driven by new collateral types. crvUSD’s expansion relies on slow, collateral-backed growth, as the DAO can’t freely print crvUSD without backing. With the current protocol design, the growth of Yield Basis will always move at the pace of Curve’s governance and crvUSD adoption.

Conclusion

Yield Basis is one of the most outstanding protocols in the BTCFi space, as the pools eliminate impermanent loss while satisfying the industry-wide demand for sustainable BTC-denominated yield. The structure delivers full price exposure, real income, and automated leverage rather than speculative rewards. However, the protocol architecture that makes Yield Basis pools so successful constrains its economics. Two core problems arise: Yield Basis growth is capped by crvUSD’s credit ceiling, while the native YB token incentives are mismatched to real earnings. Unless Yield Basis is able to scale to a 10-figure TVL before launch, user behavior will naturally tilt toward short-term staking to earn token emissions, driving sell pressure and weakening long-term alignment.

These challenges are solvable. As crvUSD matures and the Curve DAO expands Yield Basis’ credit lines, YB’s valuation will rerate toward a fairer level as the economics will align with the protocol’s value-add. The product is proven and and the demand is undeniable. Yield Basis has solved some of DeFi’s hardest structural problems. Its model could become the de facto leader in BTCFi sector, with room to expand into Gold-backed assets (XAUT/PAXG) and countless other tokens. For now, current valuations front-run that reality; the market is trading the narrative rather than the cash flow.

Sources

https://assets.dlnews.com/dlresearch/DL-Research-YieldBasis.pdf

https://x.com/yieldbasis/status/1958209415376457846

https://x.com/yieldbasis/status/1975158712466612424